SSA Approved W-2 Software

Since 1984, Account Ability has been the preferred software for tax preparers and small to midsize businesses seeking a solution to the complicated job of annual W-2 and W-2C compliance. Account Ability complies with SSA EFW2 and EFW2C specifications at the federal and state levels as well as the U.S. territories of Guam, American Samoa, Northern Mariana Islands and the Virgin Islands. With no limit to the number of employers or employees, Account Ability has always been very popular among government agencies, educational institutions, staffing companies, accounting firms and payroll service bureaus. Account Ability's user friendly interface, versatile import and reporting capabilities, electronic reporting, and unlimited toll free technical support makes for a compliance tool that no tax preparer's toolbox should be without.

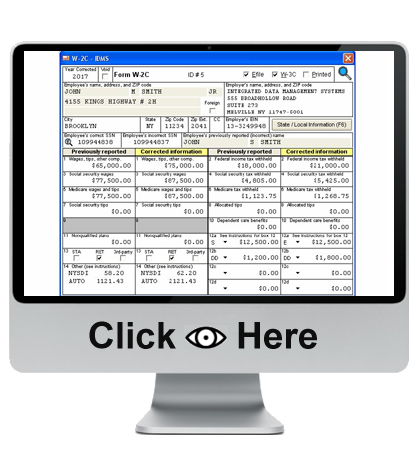

SSA Approved W-2C Software

Account Ability also includes complete W-2C and W-3C compliance for free. SSA has approved Account Ability's black and white laser drawn federal, employee, and employer copies, so you will never need to purchase preprinted W-2C or W-3C forms. The only supplies you will need are plain copy paper and envelopes in which to mail employee copies. Since our W-2C software complies with SSA EFW2C specifications, federal copies can also be delivered electronically. Support for the U.S. territories of Guam, American Samoa, Northern Mariana Islands and the Virgin Islands is also included.

*In addition to Forms W-2, W-2C, W-3 and W-3C, Account Ability also includes, at no extra charge, forms:

1098,

1098-C,

1098-E,

1098-F,

1098-T,

1099-A,

1099-B,

1099-C,

1099-CAP,

1099-DIV,

1099-G,

1099-INT,

1099-K,

1099-LTC,

1099-MISC,

1099-NEC,

1099-OID,

1099-PATR,

1099-Q,

1099-R,

1099-S,

1099-SA,

3921,

3922,

5498,

5498-ESA,

5498-SA,

W-2G,

not to mention 24/7 toll free and remote desktop technical support.